What is an Example of Passive Income?

What is an Example of Passive Income?

Feb 5, 2026

In the world of Decentralized Finance (DeFi), passive income is the process of putting your digital assets to work through autonomous smart contracts. While the core principle is similar to earning interest in a traditional bank, DeFi removes the intermediaries, allowing the "yield" to flow directly to the user.

A prime example is Staking: by "locking" your tokens to secure a blockchain network, you receive rewards in the form of newly minted tokens and a share of network transaction fees. This turns your capital into a 24/7 productive asset. However, 2025 showed us that staking was just the beginning - investors increasingly moved toward more sophisticated methods to maximize their returns.

Below, we outline the six key pillars of passive income and provide a report on their performance throughout 2025.

Pillar 1: Staking (The Safety Anchor)

Staking remains the most fundamental and "purest" form of passive income in the digital asset space. By providing security to networks like Ethereum or Solana, investors earn a share of the network’s economic activity. In 2025, Liquid Staking Tokens (LSTs) became the standard, allowing users to stay liquid while their assets were working.

2025 Performance (Quarterly APY Averages):

Quarter | Lido (stETH) | Jito (jitoSOL) | Rocket Pool (rETH) |

|---|---|---|---|

Q1 2025 | 3.6% | 7.8% | 3.4% |

Q1 2025 | 3.4% | 7.2% | 3.2% |

Q1 2025 | 3.3% | 7.0% | 3.1% |

Q1 2025 | 3.1% | 6.8% | 3.0% |

Market Insight: Staking yields were the "rock" of 2025. While other sectors saw wild swings, providers like Lido and Jito offered steady, single-digit returns. The slight compression toward Q4 was a sign of a healthy, maturing market as more total value was locked into these protocols.

Pillar 2: Restaking (The Yield Multiplier)

Restaking was the breakout star of 2025. It allows investors to take their already-staked assets and "re-use" them to secure additional services (Actively Validated Services - AVS). This creates a multiplier effect on the rewards, though it introduces a more complex technical risk profile.

2025 Performance (Quarterly APY Averages):

Quarter | Ether.fi (eETH) | Renzo (ezETH) | Puffer (pufETH) |

|---|---|---|---|

Q1 2025 | 22.0% | 24.5% | 21.0% |

Q2 2025 | 15.0% | 14.5% | 14.8% |

Q3 2025 | 12.5% | 12.0% | 12.2% |

Q4 2025 | 11.5% | 11.0% | 11.2% |

Market Insight: Staking yields were the "rock" of 2025. While other sectors saw wild swings, providers like Lido and Jito offered steady, single-digit returns. The slight compression toward Q4 was a sign of a healthy, maturing market as more total value was locked into these protocols.

Pillar 3: Lending (The Money Markets)

Lending protocols act as decentralized banks. You provide capital (usually stablecoins) to a pool, and borrowers pay you interest. This is one of the most battle-tested ways to earn, with rates driven purely by market demand for leverage.

2025 Performance (Quarterly APY Averages):

Quarter | Aave (USDC) | Morpho (USDT) | Spark (DAI/USDS) |

|---|---|---|---|

Q1 2025 | 8.2% | 9.5% | 7.0% |

Q2 2025 | 6.5% | 7.2% | 6.0% |

Q3 2025 | 4.8% | 5.5% | 5.5% |

Q4 2025 | 9.1% | 10.4% | 8.0% |

Market Insight: Lending rates in 2025 acted as a barometer for market sentiment. The spike in Q4 reflects increased demand for capital as traders positioned themselves for the year-end rally.

Pillar 4: Real World Assets (RWA - The Institutional Bridge)

RWA was the "quiet giant" of 2025, bringing off-chain financial value - specifically U.S. Treasury Bills - onto the blockchain. It provided a predictable "floor" for DeFi yields, disconnected from crypto-market volatility.

2025 Performance (Quarterly APY Averages):

Quarter | BlackRock (BUIDL) | Ondo (USDY) | Mountain (USDM) |

|---|---|---|---|

Q1 2025 | 5.2% | 5.1% | 5.0% |

Q2 2025 | 5.0% | 4.9% | 5.0% |

Q3 2025 | 4.8% | 4.7% | 4.8% |

Q4 2025 | 4.5% | 4.5% | 4.5% |

Market Insight: RWA yields remained the most stable category. The gentle decline throughout the year mirrored the Federal Reserve's adjustments to interest rates, proving that DeFi has successfully integrated with global macro trends.

Pillar 5: Liquidity Provision & Mining (The Market Makers)

Liquidity Provision (LP) allows you to act as a decentralized market maker. By providing a pair of tokens to a Decentralized Exchange (DEX), you earn a percentage of every trade executed in that pool. To attract capital, many protocols offer additional rewards in their native tokens, a process known as Liquidity Mining.

2025 Performance (Quarterly APY Averages):

Quarter | Uniswap (USDC/ETH) | Aerodrome (USDC/WETH) | Curve (TriCrypto) |

|---|---|---|---|

Q1 2025 | 25.0% | 36.3% | 12.0% |

Q2 2025 | 19.5% | 28.3% | 10.5% |

Q3 2025 | 16.6% | 25.8% | 8.2% |

Q4 2025 | 25.1% | 37.5% | 14.8% |

Market Insight: This was the most volatile category of 2025. Yields peaked during periods of high market activity (Q1 and Q4) when trading volumes - and therefore fee collection - surged. While the returns were the highest in the ecosystem, they required active management to mitigate the risk of Impermanent Loss.

Pillar 6: Stablecoin Strategies (Delta-Neutral)

For those looking to avoid the volatility of Bitcoin or Ethereum, 2025 saw the rise of advanced "Delta-Neutral" strategies. These protocols, most notably Ethena, generate yield by hedging spot assets with short positions on perpetual markets, capturing the "funding rate" (the fee paid by long traders to short traders).

2025 Performance (Quarterly APY Averages):

Quarter | Ethena (sUSDe) | Pendle (Fixed Yield) | Ethena (USDe Spot) |

|---|---|---|---|

Q1 2025 | 25.0% | 12.5% | 18.5% |

Q2 2025 | 17.3% | 10.2% | 12.0% |

Q3 2025 | 12.1% | 8.8% | 9.5% |

Q4 2025 | 20.9% | 11.5% | 15.0% |

Market Insight: Stablecoin strategies provided a unique "Internet Bond" experience. In Q1 2025, when the market was extremely "long," funding rates skyrocketed, pushing Ethena’s yield to a staggering 25%. In contrast, during the quieter summer months (Q3), yields cooled down as the market leverage decreased, proving that this pillar is a direct reflection of crypto-market "greed."

Summary: The 2025 Yield Landscape

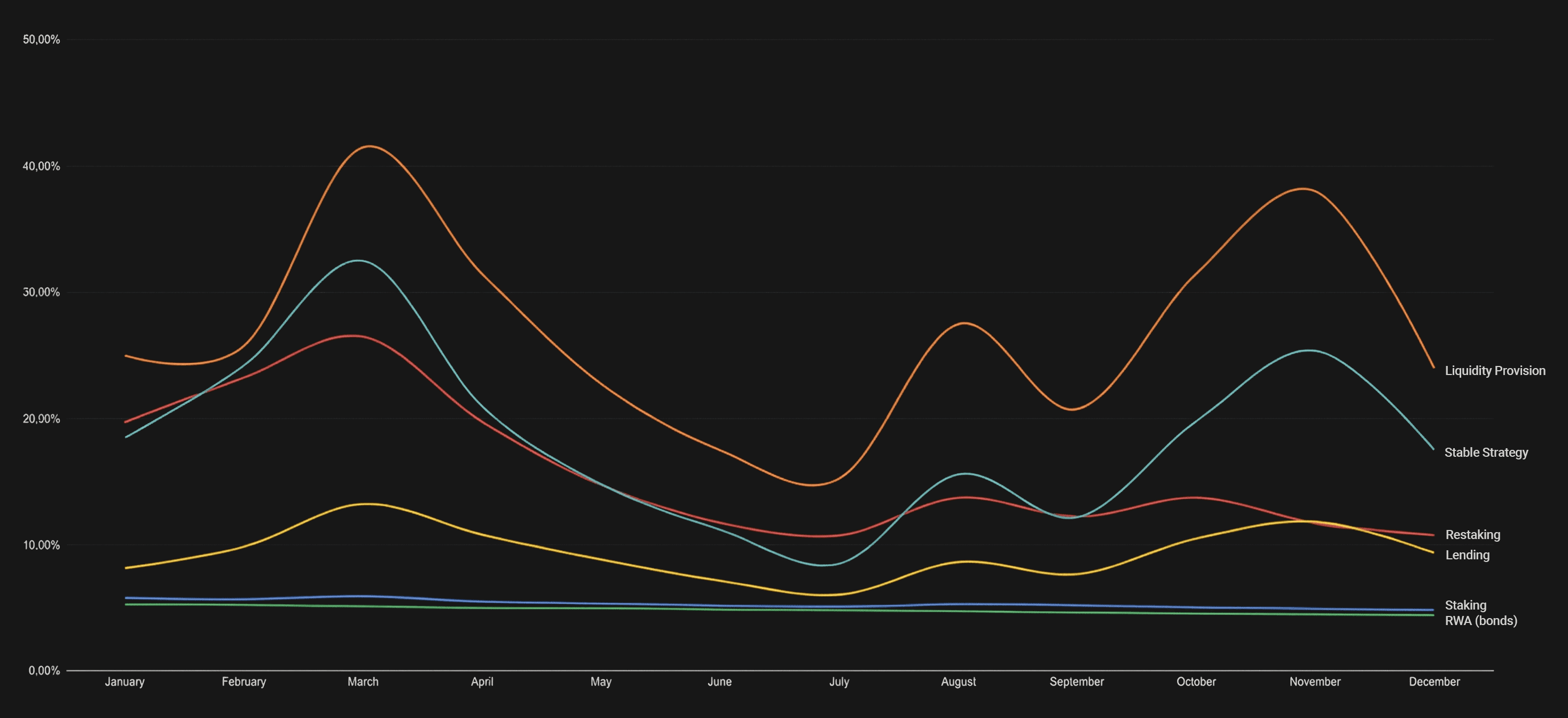

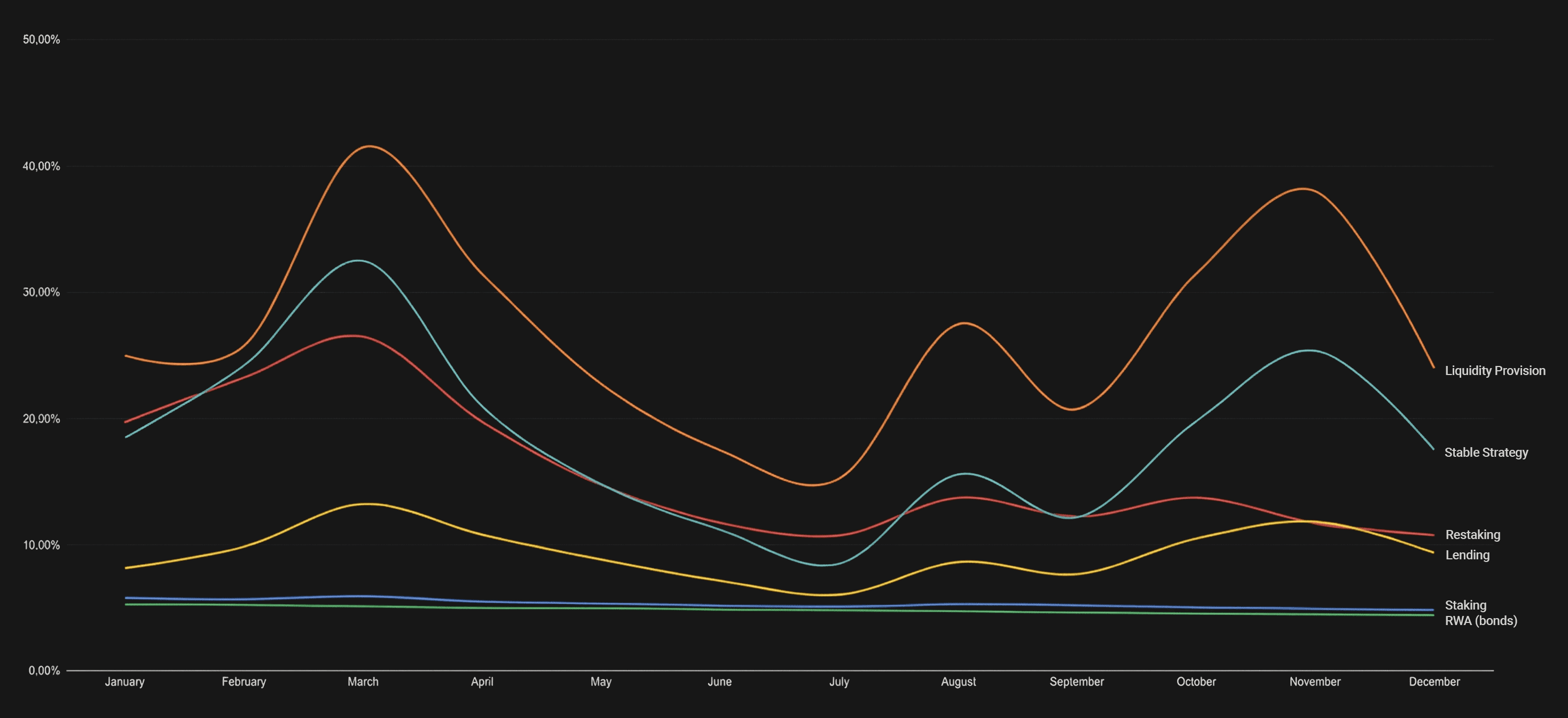

To understand the 2025 DeFi market, one must look at how these six pillars interacted. While some sectors offered a steady "safe haven," others acted as high-octane engines for growth. The chart below visualizes the monthly performance trends of each category, showing the clear divergence between institutional-grade stability and crypto-native volatility.

The "Golden Month": Why March 2025?

Looking at the chart, March stands out as the most profitable month for almost every sector (except RWA&Staking). This was due to extreme market volatility.

For DEXs: High volatility meant high trading volume, which spiked transaction fees for Liquidity Providers.

For Lending: Increased demand for leverage during market swings drove interest rates higher.

For Restaking: This period coincided with major protocol launches and airdrop snapshots, creating a "perfect storm" of yield.

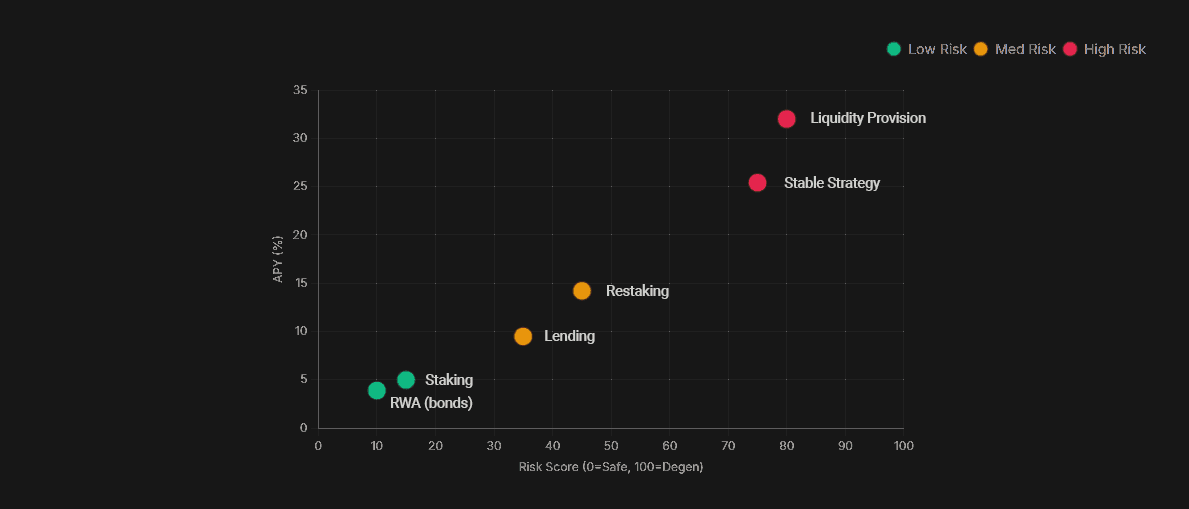

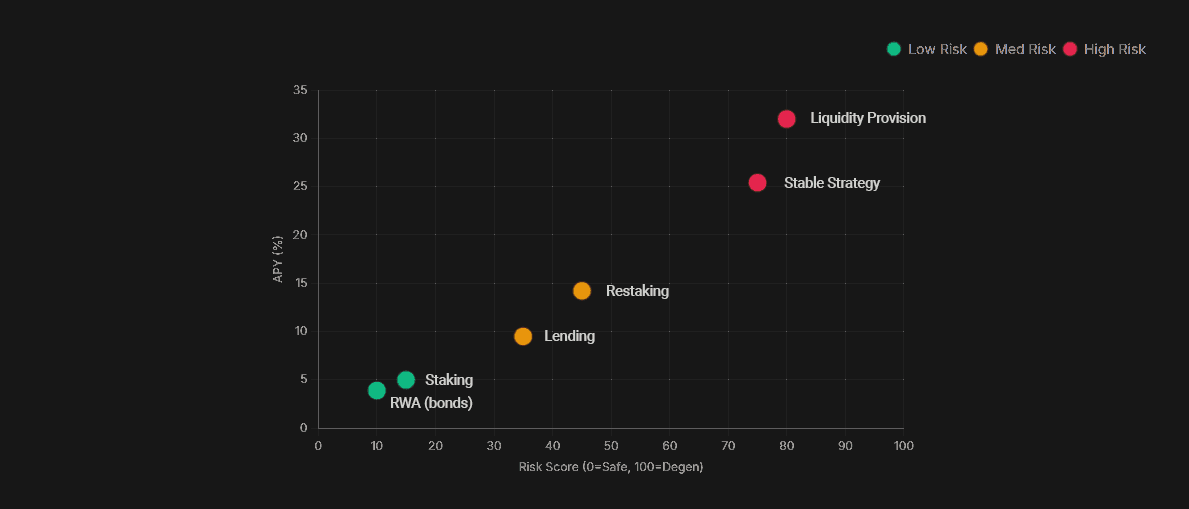

Risk vs. Reward Matrix

While high percentages are attractive, they always come with increased risk. In DeFi, risks include smart contract bugs, liquidation risk, and Impermanent Loss.

The 2025 data shows a maturing ecosystem. We have moved from the "Ponzi-nomics" of the past to a bifurcated market:

The "Safety Base": RWA and LST Staking, offering 4-6% for conservative capital.

The "Yield Engine": Restaking and LP Mining, offering 15-30% for those willing to manage active risks.

Choosing the right strategy isn't about finding the highest number; it's about finding the level of risk you can sleep with at night.

In the world of Decentralized Finance (DeFi), passive income is the process of putting your digital assets to work through autonomous smart contracts. While the core principle is similar to earning interest in a traditional bank, DeFi removes the intermediaries, allowing the "yield" to flow directly to the user.

A prime example is Staking: by "locking" your tokens to secure a blockchain network, you receive rewards in the form of newly minted tokens and a share of network transaction fees. This turns your capital into a 24/7 productive asset. However, 2025 showed us that staking was just the beginning - investors increasingly moved toward more sophisticated methods to maximize their returns.

Below, we outline the six key pillars of passive income and provide a report on their performance throughout 2025.

Pillar 1: Staking (The Safety Anchor)

Staking remains the most fundamental and "purest" form of passive income in the digital asset space. By providing security to networks like Ethereum or Solana, investors earn a share of the network’s economic activity. In 2025, Liquid Staking Tokens (LSTs) became the standard, allowing users to stay liquid while their assets were working.

2025 Performance (Quarterly APY Averages):

Quarter | Lido (stETH) | Jito (jitoSOL) | Rocket Pool (rETH) |

|---|---|---|---|

Q1 2025 | 3.6% | 7.8% | 3.4% |

Q1 2025 | 3.4% | 7.2% | 3.2% |

Q1 2025 | 3.3% | 7.0% | 3.1% |

Q1 2025 | 3.1% | 6.8% | 3.0% |

Market Insight: Staking yields were the "rock" of 2025. While other sectors saw wild swings, providers like Lido and Jito offered steady, single-digit returns. The slight compression toward Q4 was a sign of a healthy, maturing market as more total value was locked into these protocols.

Pillar 2: Restaking (The Yield Multiplier)

Restaking was the breakout star of 2025. It allows investors to take their already-staked assets and "re-use" them to secure additional services (Actively Validated Services - AVS). This creates a multiplier effect on the rewards, though it introduces a more complex technical risk profile.

2025 Performance (Quarterly APY Averages):

Quarter | Ether.fi (eETH) | Renzo (ezETH) | Puffer (pufETH) |

|---|---|---|---|

Q1 2025 | 22.0% | 24.5% | 21.0% |

Q2 2025 | 15.0% | 14.5% | 14.8% |

Q3 2025 | 12.5% | 12.0% | 12.2% |

Q4 2025 | 11.5% | 11.0% | 11.2% |

Market Insight: Staking yields were the "rock" of 2025. While other sectors saw wild swings, providers like Lido and Jito offered steady, single-digit returns. The slight compression toward Q4 was a sign of a healthy, maturing market as more total value was locked into these protocols.

Pillar 3: Lending (The Money Markets)

Lending protocols act as decentralized banks. You provide capital (usually stablecoins) to a pool, and borrowers pay you interest. This is one of the most battle-tested ways to earn, with rates driven purely by market demand for leverage.

2025 Performance (Quarterly APY Averages):

Quarter | Aave (USDC) | Morpho (USDT) | Spark (DAI/USDS) |

|---|---|---|---|

Q1 2025 | 8.2% | 9.5% | 7.0% |

Q2 2025 | 6.5% | 7.2% | 6.0% |

Q3 2025 | 4.8% | 5.5% | 5.5% |

Q4 2025 | 9.1% | 10.4% | 8.0% |

Market Insight: Lending rates in 2025 acted as a barometer for market sentiment. The spike in Q4 reflects increased demand for capital as traders positioned themselves for the year-end rally.

Pillar 4: Real World Assets (RWA - The Institutional Bridge)

RWA was the "quiet giant" of 2025, bringing off-chain financial value - specifically U.S. Treasury Bills - onto the blockchain. It provided a predictable "floor" for DeFi yields, disconnected from crypto-market volatility.

2025 Performance (Quarterly APY Averages):

Quarter | BlackRock (BUIDL) | Ondo (USDY) | Mountain (USDM) |

|---|---|---|---|

Q1 2025 | 5.2% | 5.1% | 5.0% |

Q2 2025 | 5.0% | 4.9% | 5.0% |

Q3 2025 | 4.8% | 4.7% | 4.8% |

Q4 2025 | 4.5% | 4.5% | 4.5% |

Market Insight: RWA yields remained the most stable category. The gentle decline throughout the year mirrored the Federal Reserve's adjustments to interest rates, proving that DeFi has successfully integrated with global macro trends.

Pillar 5: Liquidity Provision & Mining (The Market Makers)

Liquidity Provision (LP) allows you to act as a decentralized market maker. By providing a pair of tokens to a Decentralized Exchange (DEX), you earn a percentage of every trade executed in that pool. To attract capital, many protocols offer additional rewards in their native tokens, a process known as Liquidity Mining.

2025 Performance (Quarterly APY Averages):

Quarter | Uniswap (USDC/ETH) | Aerodrome (USDC/WETH) | Curve (TriCrypto) |

|---|---|---|---|

Q1 2025 | 25.0% | 36.3% | 12.0% |

Q2 2025 | 19.5% | 28.3% | 10.5% |

Q3 2025 | 16.6% | 25.8% | 8.2% |

Q4 2025 | 25.1% | 37.5% | 14.8% |

Market Insight: This was the most volatile category of 2025. Yields peaked during periods of high market activity (Q1 and Q4) when trading volumes - and therefore fee collection - surged. While the returns were the highest in the ecosystem, they required active management to mitigate the risk of Impermanent Loss.

Pillar 6: Stablecoin Strategies (Delta-Neutral)

For those looking to avoid the volatility of Bitcoin or Ethereum, 2025 saw the rise of advanced "Delta-Neutral" strategies. These protocols, most notably Ethena, generate yield by hedging spot assets with short positions on perpetual markets, capturing the "funding rate" (the fee paid by long traders to short traders).

2025 Performance (Quarterly APY Averages):

Quarter | Ethena (sUSDe) | Pendle (Fixed Yield) | Ethena (USDe Spot) |

|---|---|---|---|

Q1 2025 | 25.0% | 12.5% | 18.5% |

Q2 2025 | 17.3% | 10.2% | 12.0% |

Q3 2025 | 12.1% | 8.8% | 9.5% |

Q4 2025 | 20.9% | 11.5% | 15.0% |

Market Insight: Stablecoin strategies provided a unique "Internet Bond" experience. In Q1 2025, when the market was extremely "long," funding rates skyrocketed, pushing Ethena’s yield to a staggering 25%. In contrast, during the quieter summer months (Q3), yields cooled down as the market leverage decreased, proving that this pillar is a direct reflection of crypto-market "greed."

Summary: The 2025 Yield Landscape

To understand the 2025 DeFi market, one must look at how these six pillars interacted. While some sectors offered a steady "safe haven," others acted as high-octane engines for growth. The chart below visualizes the monthly performance trends of each category, showing the clear divergence between institutional-grade stability and crypto-native volatility.

The "Golden Month": Why March 2025?

Looking at the chart, March stands out as the most profitable month for almost every sector (except RWA&Staking). This was due to extreme market volatility.

For DEXs: High volatility meant high trading volume, which spiked transaction fees for Liquidity Providers.

For Lending: Increased demand for leverage during market swings drove interest rates higher.

For Restaking: This period coincided with major protocol launches and airdrop snapshots, creating a "perfect storm" of yield.

Risk vs. Reward Matrix

While high percentages are attractive, they always come with increased risk. In DeFi, risks include smart contract bugs, liquidation risk, and Impermanent Loss.

The 2025 data shows a maturing ecosystem. We have moved from the "Ponzi-nomics" of the past to a bifurcated market:

The "Safety Base": RWA and LST Staking, offering 4-6% for conservative capital.

The "Yield Engine": Restaking and LP Mining, offering 15-30% for those willing to manage active risks.

Choosing the right strategy isn't about finding the highest number; it's about finding the level of risk you can sleep with at night.